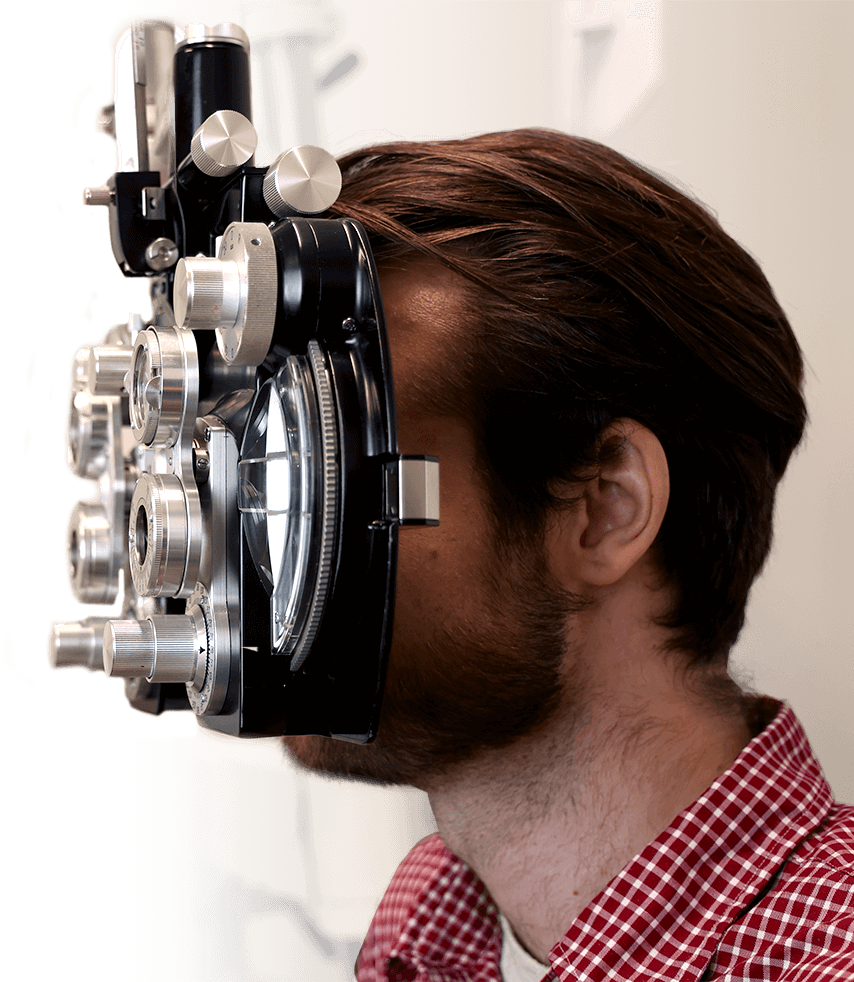

Eye Exams

Eye Exams

FSA and HSA funds can be used to pay for eye exams at any Heartland Vision location.

Book Eye ExamFlexible Spending Accounts (FSA) and Health Savings Accounts (HSA) are specialized accounts for healthcare expenses that are funded with pre-tax dollars. These programs are commonly offered by employers, usually in conjunction with a standard health plan.

| 2025 Benefit Period Begins | January 1, 2025 |

| Last day to incur expenses using your 2025 HCFSA or LEX HCFSA | December 31, 2025 |

| Last day to incur expenses using your 2025 DCFSA | March 15, 2026 |

| Last day to submit all claims for the 2025 benefit period | April 30, 2026 |

The statutory deadline for contributing to your HSA is the same deadline for filing your taxes for the same year (2025 HSA contribution deadline: April 15, 2026).

Medical expenses that are eligible, including vision care, can be covered by FSA and HSA funds. At Heartland Vision, you can use your FSA and HSA money to pay for out-of-pocket expenses and copays related to the following:

No worries! At Heartland Vision, we do complimentary insurance checks. And if you have any questions, feel free to call or send a message. See if you’re covered:

Most providers will let you use your FSA or HSA funds to pay for blue light glasses. Blue light lenses filter out blue light produced by phones, TVs and computer monitors which have been proven to negatively affect sleep and cause eye strain. Therefore, blue light lenses have proven medical benefits and applications.

There is no limit! As long as you have enough money in your FSA to purchase a pair of glasses, you can.

FSA funds can only be used for yourself and qualifying dependents. Eligible dependents include your spouse, your children (under 26 years old) and other dependents claimed on your tax return.

You cannot use FSA funds towards cosmetic contact lenses. However, if the colored contact lenses have corrective properties to improve your vision, they will have been prescribed to you by a licensed doctor. Colored lenses with corrective properties are eligible for FSA fund use.

You can use your flexible spending account to purchase prescription sunglasses. However, non-prescription sunglasses are not an eligible item.

Eyeglass frames are an eligible item to be purchased with FSA and HSA funds.